TCS Share Price

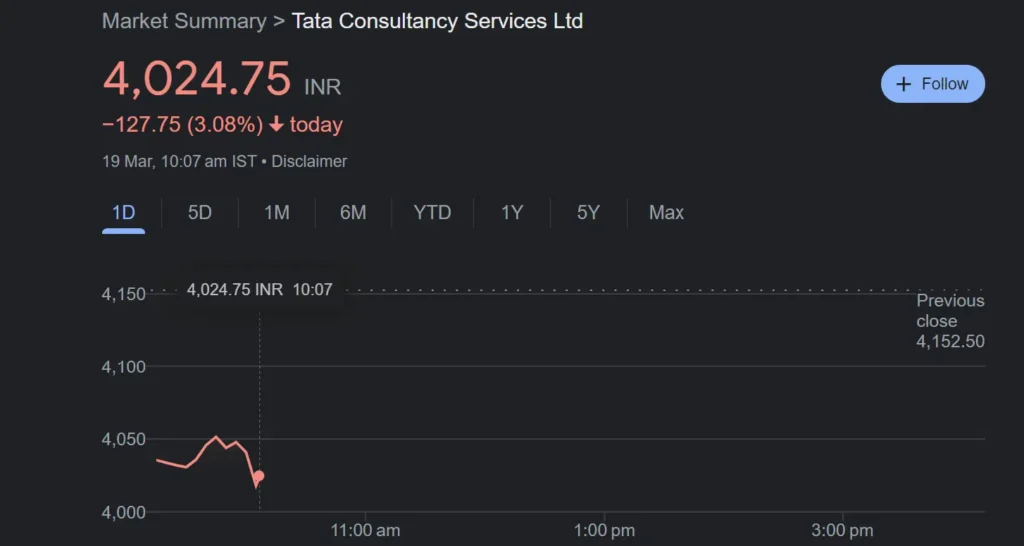

TCS share price dropped today, hitting a low of ₹4,022 per share on the NSE, down 3% from yesterday’s closing price of ₹4,152.50.

Is it Wise to Buy Now or Await Further Correction?

The decline happened as Tata Sons announced plans to sell some of its stake in Tata Consultancy Services (TCS), aiming to raise over a billion dollars. This news caused a sell-off in TCS shares during Tuesday morning trading.

Investors quickly reacted by pushing TCS share price down further early in the day. The stock started low and continued to fall, reaching the mentioned intraday low.

As investors watch closely, they’re considering how Tata Sons’ potential stake sale could affect TCS’s performance in the future.

The market’s response shows how important Tata Sons’ move is for TCS’s value. Analysts are discussing why Tata Sons might want to sell part of its TCS shares, thinking about things like spreading risk, deciding where to invest, and reshaping the Tata Group.

Besides the short-term changes in the market, people are also thinking about TCS’s long-term future. They’re looking at things like how fast TCS is growing, its position compared to other companies, and what’s happening in the industry.

While Tata Sons’ news makes TCS’s share price drop, investors are waiting to see what happens next and how TCS responds. They want to know if TCS can keep growing and doing well in the future, even with this news.

Conclusion

The drop in TCS share price following news of Tata Sons’ stake sale highlights the significant impact of corporate decisions on stock valuation. As investors assess the implications of this development, they scrutinize TCS’s strategic direction and ability to navigate market challenges. While short-term fluctuations are inevitable, long-term investment decisions should consider TCS’s fundamental strengths, growth prospects, and competitive positioning in the IT services sector.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy or sell securities. Investing in the stock market involves risks, and individuals should conduct their research or consult with a financial advisor before making investment decisions. The author and the platform do not guarantee the accuracy or completeness of the information provided, and they shall not be held liable for any losses or damages arising from the use of this information.